Under the instruction of the Chief Minister of the Bhagwant Maan, the State Government of Punjab launched the CRM Loan Scheme 2025 through Cooperative Banks. Here, CRM Stands for Crop Residue Management Loan Scheme, which is now given through the Cooperative Banks all over the state. After the announcement of this scheme, this is also known as the major steps which is taken to curb stubble burning. The announcement of the scheme was made on 11th September 2025 by the Chief Minister. If you are also a citizen of the Punjab and want to avail the benefits under this scheme, then you must have to collect the complete information about the scheme.

CRM Loan Scheme Punjab

Recently, the state government of Punjab launched the CRM Loan scheme to provide benefits to Farmers and cooperative societies to get easy access to modern machines. This scheme is also opening new opportunities for the farmers to earn in new ways. With the help of the machines, they help manage paddy straw to collect for other uses.

| Name of scheme | CRM Loan Scheme (Crop Residue Management) |

| Launching Date | 11th September 2025 |

| Beneficiaries | Farmers, PACS, MPCS, EPO Panchayat |

| Subsidy | For Farmers 50% For PACS/MPCS 80% |

| Loan Repaid duration | 5 years in 10 half-yearly instalments |

| How to apply | Online/offline |

Crop Residue Management Scheme Punjab

The aim of launching this scheme is to provide help to all the farmers and cooperative societies of the Punjab to buy the crop residue Management Machinery. It will also help to reduce the air pollution season-wise and create opportunities for the Rural communities of the Punjab state. The scheme is launched under the Financial Commissioner of Cooperatives and Registrar of Cooperative Societies.

- Reduce the seasonal pollution in the state.

- Provide financial help to the farmers of the state to buy new machines, and it will reduce their field work.

- Also help to provide credit to eligible farmers and cooperative societies through banks.

CRM Loan and Subsidy

Under this scheme, the PACS ( Primary Agricultural Cooperative societies) and MPCS ( Multi Purpose Cooperative Societies) will get the subsidy up to 80% on the machines with a maximum limit of Rs 24 Lakhs, while keeping the 100 percent margin amount.

Apart from the above, the eligible farmers will get the subsidy upto 50% on the machine and 25% on the margin amount. The loan which is taken under this scheme can be repaid within 5 years, which means you have to pay the whole amount in 10 half-yearly instalments, i.e. till 30th June and 31st January of every year.

Machines Available under CRM Scheme

- Supper Seeders

- Happy Seeders

- Balers

- Cutters

- Tedders

- Rakers

- Loader

- Grabbers

- Telehandler

- Tractor with high power of 60HP

Eligibility Criteria

- All the Permanent citizens of the Farmers, PACS, FPO, Panchayat and MPCS of Punjab state.

- You are not be defaulter in any of the government loans.

- Priority should also be given to the Farmers.

Punjab CRM Subsidy Loan Scheme Apply Online

There are two ways to apply for this scheme, i.e. offline and online. So here, one by one, I am going to discuss both ways.

Offline Application Process

- All the eligible Farmers and Societies who want to apply under this scheme can apply through the Cooperative Banks and through PACS of their area.

- First, you have to visit your nearest PACS or Cooperative Banks with your Kisan ID Card, ID proof or Land Papers.

- Then collect the application form and fill it and attach the documents.

- If your project is big, then you have to attach the proposal to the application form.

- Then, after collecting your form along with documents, the bank will process and forward your cases to the next step.

- After a physical check of the machinery, you will get the subsidy and loan.

- Then, after getting the loan and subsidy, you must have to pay the loan instalment as per the schedule given above.

Online Application Process

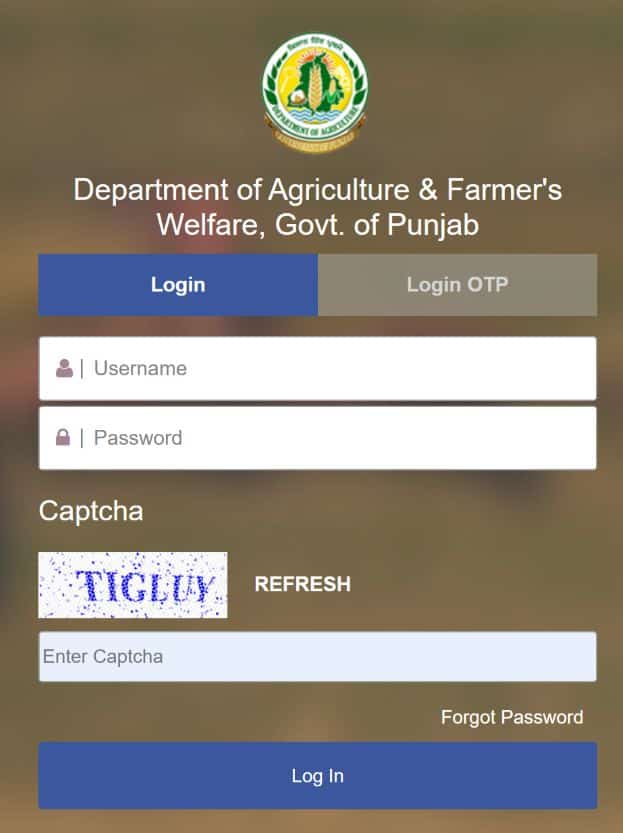

- To submit an online application form, you need to open the official website of the Punjab Agriculture Scheme Subsidy Portal, i.e. agrimachinerypb.com.

- Here you will get the complete details and guidelines about the scheme, and then click to apply online.

- Fill the application form, upload the documents and then submit.

Important Links

FAQ

You will get the loan from the Cooperative Banks of the Punjab state.

Yes, you can apply from both modes, i.e. online as well as offline.